Multiple Account Reporting for Georgia Quarterly Tax and Wage Report

Human Resources > State Requirements > GA > Quarterly Tax and Wage Report

The Georgia Quarterly Tax and Wage Report has been enhanced to run for separate account numbers.

The following setup is required:

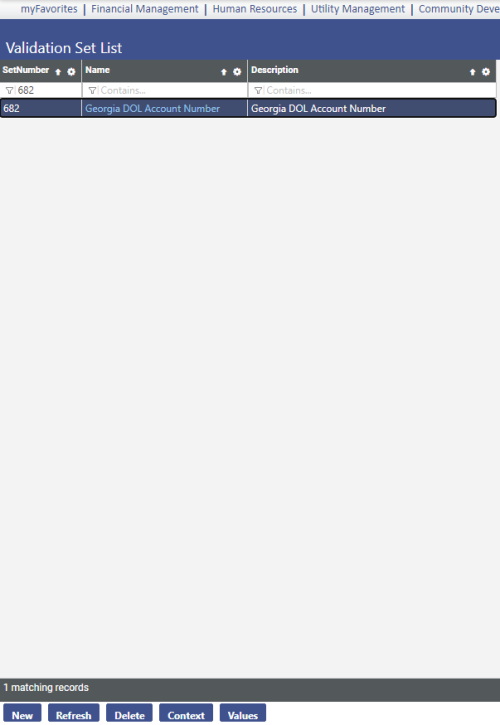

Validation set 682, Georgia DOL Account Number, has been created for you. All you need to do is add the appropriate accounts to it:

- Navigate to Maintenance > new world ERP Suite > System >Validation Sets > Validation Set List.

-

Search for and select the grid row containing validation set number 682:

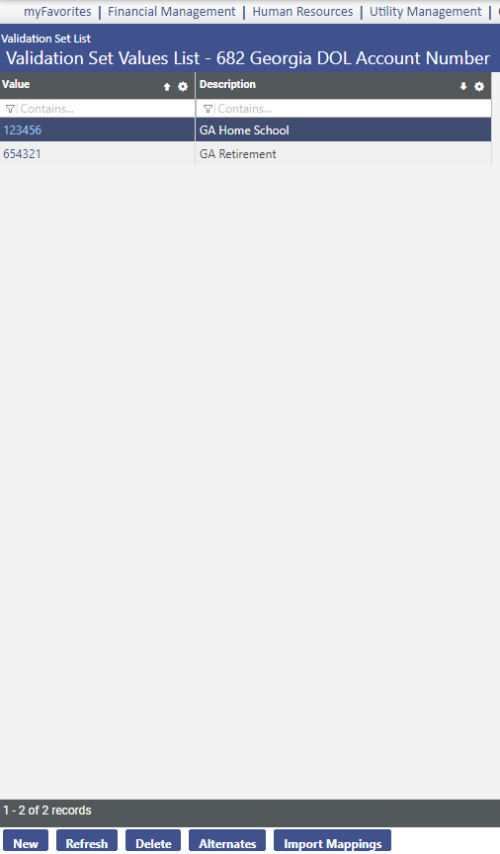

- Click Values. The Validation Set Values List page displays.

- Click New. The Validation Set Value page displays.

- In the Value field, enter the GA DOL account number.

- In the Description field, enter a description of the account.

- Click Save/New.

- Repeat steps 5-7 for each of the remaining accounts.

- Click Save.

-

Breadcrumb back to the Validation Set Values List page, where the accounts should display in a grid:

These accounts are available for selection on the dropdown of the user-defined field (UDF) you will create next.

Follow these steps to create the field that displays on the Employment tab of Workforce Administration:

- Navigate to Maintenance > new world ERP Suite > Security > User-Defined Fields.

- In the Select a Record Type dialog, select Employee Employment.

- Click Ok. The User-Defined Fields Maintenance-Employee Employment page displays.

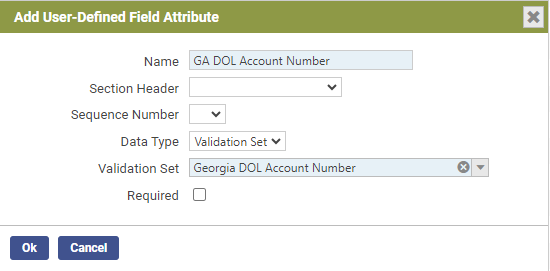

- Click New. The Add User-Defined Field Attribute dialog displays.

-

Make entries as shown in the image below:

- Click Ok. The field is added to the grid on the User-Defined Fields Maintenance-Employee Employment page and to the User-Defined Fields section of the Employee Employment tab in Workforce Administration.

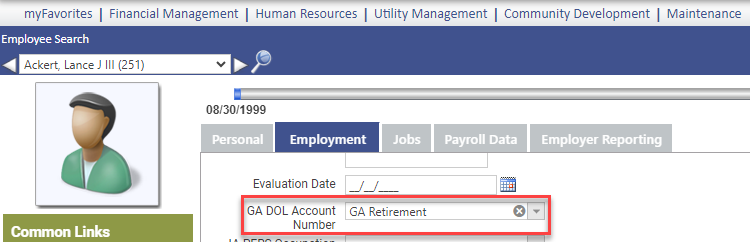

The next step is to apply the appropriate GA DOL account numbers to employees in Workforce Administration:

- Navigate to Human Resources > Workforce Administration > Search > Employee > Employee Employment > Edit.

-

From the GA DOL Account Number dropdown, select the appropriate account (account descriptions display on the dropdown):

- Click Save.

- Repeat these steps for each employee.

You are ready to run the Georgia Quarterly Tax and Wage Report.

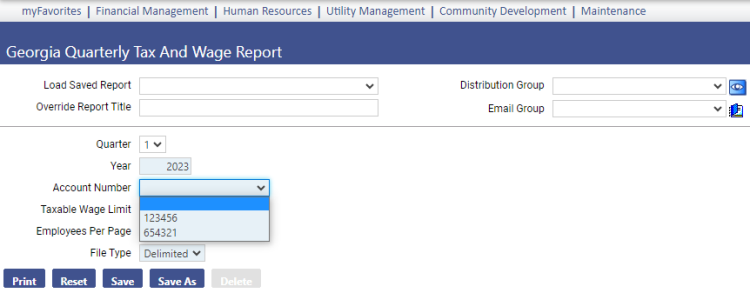

Once you have performed the necessary setup, navigate to Human Resources > State Requirements > GA > Quarterly Tax and Wage Report. The Account Number field is now a dropdown containing the GA DOL accounts you set up in the validation set:

Run a separate report and transmittal file for each account as applicable. The report and transmittal contain only the employees matching the selected account number.